Welcome to WhatsMedicare.com!

Helping You Navigate The Medicare Maze Is What We Do... Let Us Make This Easy For YOU!

You Deserve Stress-Free Golden Years...

Learn How To Take Advantage of Medicare Without It Taking Advantage Of You!

Check out our complimentary 10-Minute Medicare overview video by clicking the button below

If You Have Any Questions At All, Don't Forget...

WE'RE HERE TO HELP!

Jim Maher & Katie Burris

Certified Senior Advisor®, Long-Term Care Insurance Specialist

(916) 781-3321

See which plan is best for your Part D prescription drugs!

How to Look Up 2026 Medicare Part D Plans

1. Go to www.Medicare.gov

Click “Find Plans”

Enter your ZIP code and answer a few questions

2. Add Your Medications

Enter your prescriptions and choose your pharmacy

3. Compare Plans

Review 2026 Part D options

Compare premium, deductible, and estimated yearly drug costs

4. Enroll Online

Click “Enroll” on the plan you choose

Have your Medicare number and Part A/B dates ready

5. Confirmation

Medicare.gov gives you a confirmation number

Your new plan will send an ID card to you.

NEW Individual Dental Plans!

ALL ages, NO waiting periods, and PERFECT for medicare-aged individuals!

2026 Medicare Two Page Reference Guide

Navigating the Medicare Maze...

While we are not affiliated with the Government, CMS, Medicare or Social Security, we have made it our goal to help as many people as possible with the Medicare process.

To learn more about medicare and how you can select the plan(s) that work best for you, simply scroll down on this page, or reach out to us at any time!

Our licensed professionals are standing by to assist you, and leverage our decades of experience to make sure you get the answers to the questions you're looking for.

Questions that we commonly answer include...

When, Where & How Do I Enroll?

How Much Does it Cost?

Do I Need to Enroll?

What Does it Cover?

What if I am Over 65 and Still Working?

What if I'm Still on COBRA?

What Happens When I Retire?

Complimentary Medicare Resources

Oftentimes, it’s not easy to understand, so we have tried to provide you with some basic information and resources that will help you with the A,B,C and D’s of Medicare. We hope it helps and makes Medicare a little less complicated! Most importantly, what Insurance options are best for you?

There is no one cookie-cutter answer as everyone has different needs and means. Give yourself plenty of time and start investigating all of your options!

We are here to be a resource and help you with your Medicare questions. Always feel free to call us or email with any questions or concerns you may have. We look forward to being of service!

NEW Individual Dental Plans!

ALL ages, NO waiting periods, and PERFECT for medicare-aged individuals!

Before Trying To Comb Through All The Information Yourself, Take A Look At A Complimentary Educational Video We Put Together...

"How To Take Advantage Of Medicare Without It Taking Advantage Of You!"

In Less Than 15 Minutes, This Complimentary Educational Video Will Show You...

The 4 Parts of Medicare You MUST Be Aware Of

Enrollment Periods, Deadlines, & What To Do

How Other Insurance Works With Medicare

What Medicare DOESN'T Cover & Your Options

"I'm Here for You!"

If you're confused about Medicare, don't worry! You're not alone. I have worked with thousands of individuals, helping them to navigate the Medicare Maze. This is my passion and my expertise."

- Jim Maher

Ok... So What is Medicare And These 4 Parts I Keep Hearing About?

Medicare is our national health plan for people aged 65 and older or under age 65 with certain disabilities.

President Lyndon Johnson signed the bill establishing Medicare in 1965. The first Medicare enrollee in July 1966 was former President Harry Truman. It was simple then. Only two parts: Part A, the Hospital side and Part B, the Medical side. The confusion lies with the fact that Medicare is part of Social Security. People have a hard time distinguishing between the two. Just remember that Medicare is the “health one” and Social Security is “the money one!” Here is a brief overview of what makes up Medicare today...

Part A

"...the Hospital side"

Part A is the Hospital side. It really covers Hospital care, skilled nursing care (not long term care), Hospice, which is end of life care and Home Health Services

How much does it cost? The government tells you it is “premium free” but there is nothing free about it. You pre-fund Part A through your Medicare payroll taxes. You pay 1.45% and your employer pays 1.45%. If you’re self-employed you are really lucky and pay the entire 2.9%!

Part B

"...the Medical side"

Part B is the Medical side. It covers medically necessary services including doctors services, outpatient care, home health services, durable medical equipment and other medical services. Part B also covers Preventive and screening services.

The cost: for most people it’s $202.90/month for 2026. But wait, it gets better because they now “means” test Part B premiums!

To see the 2026 Income Related Monthly Adjustment Amount (IRMAA) Click Here

That means if you are a larger earner, individual or couple, you will pay additional premiums. The government looks back at your tax return from two years ago and will charge you higher Part B premiums if you had more income then. In technical terms it is referred to as Income Related Monthly Adjustment Amounts (IRMAA).

Part B late enrollment penalty. If you don’t sign up when you are supposed to, you can be fined. The fines can last a lifetime for Part B! Don’t let it happen to you. Technically, they fine you 10% of the Part B premium for every 12-month period that you could have had Part B, but didn’t enroll. It’s bad.

Part C

"Medicare Advantage"

Part C is an “HMO” type plan that most people are familiar with. It is called Medicare Advantage.

These plans are run by private insurance companies. The government pays them a fee to take care of you. You still have Medicare Parts A & B (which is called Original Medicare) but your care is being provided by a Private Insurance Company. Part C usually combines hospital costs, doctors visits and other medical services, plus prescription drug coverage. Sometimes they throw in a dental and vision plan. The rules are different and you need to understand them before you sign up.

You can view a great video on How Part C works in our complimentary video library by clicking the button below:

Part D

"prescription drug coverage"

Part D is prescription drug coverage that you buy from an Insurance Company. This is a separate plan that just covers your drugs. You must have Part A & B of Medicare to buy a stand alone Part D Rx plan. You are not automatically enrolled onto Part D. You must be a good consumer and shop around to find the plan that best fits your needs.

You need to understand how the deductible, copays, co-insurance and coverage gap (formerly known as the donut hole) works. It's important to understand Part D Costs. And by the way, there is now a charge based on your income (referred to as IRMAA).

If You Have Any Questions At All, Don't Forget...

WE'RE HERE TO HELP!

Jim Maher & Katie Burris

Certified Senior Advisor® Long-Term Care Insurance Specialist

(916) 781-3321

TYPES OF INSURANCE PLANS AVAILABLE

One of your most important steps to making sure your coverage is tailored to your unique situation

So...

What type of Insurance Plans are Available for Someone on Medicare?

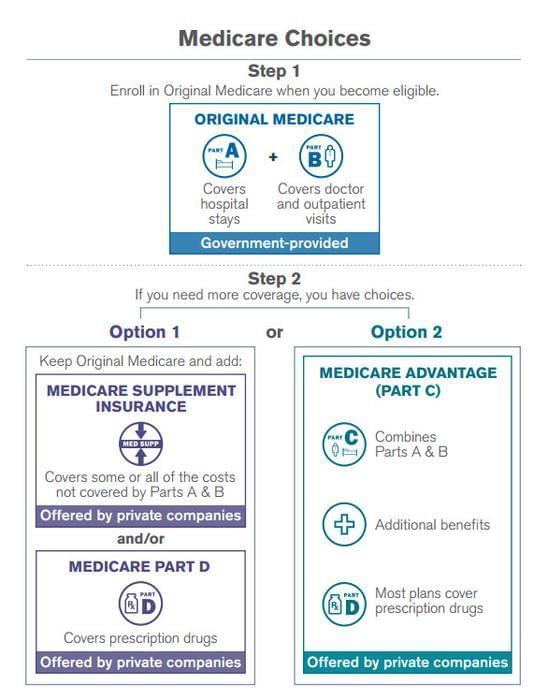

You really have two options.

You can purchase a Medicare Supplement plan or choose a Medicare Advantage Plan.

Either way, you must sign up for Medicare Part A and Part B:

Medicare Supplement/Medigap

If you want to go the supplement route then you need to find a Medicare Supplement or Medigap plan (they mean the same thing and help cover your deductibles, co-pays and coinsurance.) Hence their names! You have so many choices and every insurance company wants your business. They say they all have the best plans, choices and costs.

Be a smart consumer and shop around. All Medicare Supplement plans are standardized (that means the benefits are identical with every Insurance Company that sells Plans A-N) For Example: Plan F benefits are the same with every company that sells them but pricing is different and there can be a huge gap between lowest and highest priced policies.

My mom always told me not to buy cheap and was she ever right in regards to a Medicare supplement plan. You want a good solid company that has been in the Medicare Supplement market for years.

Medicare Advantage Plans

Medicare Advantage Plans are a different animal. They are not a supplement but plans offered by private insurance companies. Part C, Medicare Advantage plan combines Part A & B (yes you still have to have them) and usually includes your Prescription drug plan and additional benefits like dental and vision. Make sure you understand the different choices available, and what best fits your unique situation.

Signing Up For Coverage

Why do I need to sign up?

It’s simple. It’s Insurance and that is how insurance works. You must sign up or pay a penalty.

If the government didn’t charge a penalty then people may not sign up. Remember, Insurance only works when you have large numbers of healthy people and smaller numbers of unhealthy people.

That spreads the risk. Medicare is nothing more than a Government run Insurance Plan. The Affordable Care Act (Obamacare), for people under 65, works like Medicare, too. People must sign up or pay a penalty!

Where Do I Sign Up?

You can go to your Social Security office but why ruin your day? (Remember that you sign up through Social Security-not Medicare.)

Online is easiest: Medicare Application. If you are already receiving Social Security or Railroad Retirement you will automatically be enrolled in Parts A & B. Doesn’t mean you have to keep Part B. There are exceptions such as you or your spouse are still actively working and on an employer sponsored group plan through a company that employs more than 20+ employees.

When do I need to sign up?

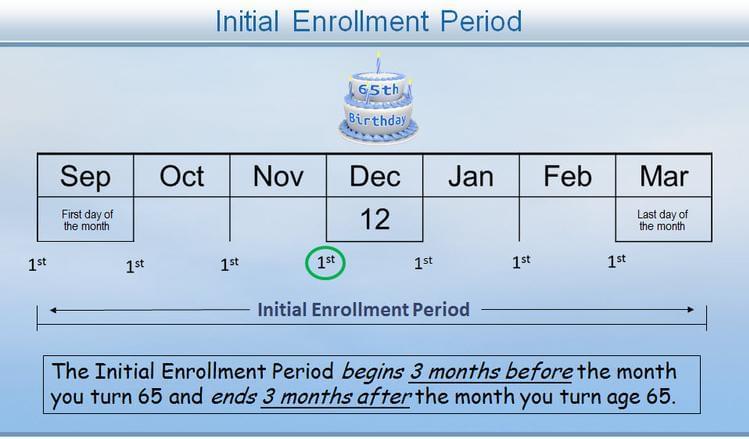

Everyone must sign up or enroll for Medicare when they turn 65 or face a penalty.

You can enroll in Parts A & B three months prior to the month you turn 65, the month you turn 65 and three months after. This is the Initial Enrollment Period (IEP).

If your birthday is December 12th, the example below shows your Initial Enrollment Period.

There is one main exception!

If you are enrolled on your employer's or spouse's employer's group health plan and the employer has 20 or more employees then you have options.

We know this can seem very confusing, so we highly recommend giving us a call and we will help you understand your unique circumstance: 916-781-6430

Want To Learn More About Enrollment Periods?

Frequently Asked Questions

For any question(s) you should always feel free to call Social Security at (800) 772-1213 or Medicare at (800) 633-4227. Remember, they are there to help you. Make sure you note who you talk to, the date and what they advise. There is something called Equitable Relief. If you are given incorrect information, you can appeal based on the information you were given by the government worker but you will need notes with details!

How do I know what Part of Medicare covers my Prescription drugs?

You would really think that Part D would cover all since it is the Prescription Drug Plan but that’s not how it really works.

Part D covers outpatient drugs through private insurance companies.

Part B covers drugs administered by your doctor or from a dialysis center, including oral cancer drugs-chemotherapy and a limited number of outpatient drugs.

Part A would cover your drugs when you are in a Medicare covered stay in either a skilled nursing facility or hospital.

I know it's confusing, especially knowing which Part covers what, but we have some helpful links and other information in our free Resource Library that you can access by clicking HERE.

Can they really charge me more for my Part B and Part D premiums?

Yes, they can. It is called an Income Related Monthly Adjustment Amount (IRMAA for short). You will pay more depending on your income from two years ago. The government looks back at your Modified Adjusted Gross Income (MAGI) from 2 years ago.

Every year, they do a 2-year look back at your Tax Return. For 2026, they are looking at your 2024 return. In 2027, they will look at your 2025 return, etc. Most people pay the $202.90 per month in 2026.

That’s the amount that is either deducted from your Social Security check or, if you are not receiving SS, will be billed to you quarterly. The threshold is currently $109,000 for individual and $218,000 for couples filing a joint return.

If you show more income than the threshold amount, then you pay higher Part B and Part D premiums!

I have group coverage through my employer (there are less than 20 employees) do I have to sign up for Medicare when I turn 65?

The Answer is yes. You need to sign up for Parts A & B. Remember the Initial Enrollment Period is three months before you turn 65, the month you turn 65 and three months after you turn 65.

Here is why: Medicare becomes the Primary Payer when the company has less than 20 employees. If you don’t sign up for Medicare and have a claim, The Insurance Company can deny payment because Medicare should be the primary payer and the Insurance Company is secondary.

What if I am working for a large company and they provide group health insurance. Do I need to sign up for Part A and Part B of Medicare?

The simple answer is No.

The group plan is the primary payer and therefore you do not need to sign up for Parts A and B. The government recommends that you enroll for Part A because it is premium free. If you are contributing to an HSA, then you don’t want to sign up for Medicare.

The IRS says you and/or your employer cannot fund an HSA if you are over 65 and on any Parts of Medicare.

How do I know when Medicare pays primary (first) and my plan pays secondary (second)?

There are so many scenarios that you need to know especially relating to group coverage.

We made it simple. Click Below for how Medicare coordinates with other coverages.

Medicare seems to be all acronyms. What do they mean and where can I find all of these Medicare terms defined?

Instead of publishing 25 pages of terms and initials, I found a great resource that alphabetizes many Medicare terms, that you can view in our Free Resource Library by Clicking Here

I am so confused about the Part D Rx Plan. How does it really work in 2026?

In 2026, Medicare Part D will feature a $2,100 annual cap on out-of-pocket costs for prescription drugs. Meaning, once you reach that amount, you will not have to pay any additional cost for covered Part D medications for the rest of the year. This applies to all Medicare Part D plans, including Medicare Advantage plans with prescription drug coverage.

There is no longer a Donut-Hole with Part D plans!

I’m afraid to call any government agency. What if I feel I was discriminated against, unsure if my claim was processed incorrectly, think someone was committing Medicare fraud or just don’t understand anything? Are there any Medicare rights that I have?

You shouldn’t fear calling any government agency.

You have a ton of rights and you should not take no for an answer. If you disagree with someone from Medicare or Social Security, you need to call and ask for a supervisor.

Call Medicare 1 (800) 633-4227 and for Social Security 1 (800) 772-1213. You have the right to file a complaint or appeal. You have a right to know what’s covered and what isn’t.

Can Medicare just decide not to cover a service or procedure that I already received or am about to have done?

No.

If the Doctor or health care provider thinks that Medicare won’t pay for something then you will be given an “Advance Beneficiary Notice of Noncoverage”. They have to show you ahead of time what they believe Medicare will not pay for.

If you disagree you can always appeal. Remember, don’t take NO for an answer!

TESTIMONIALS

What others are saying

"You and your company have always set me up with the best programs available. All of you have gone over and beyond answering all of my questions. You are pleasant, knowledgeable, and a joy to work with."

- Connie

"Jim is very knowledgeable about Medicare and its benefits. He does all the research for you and offers you options for what best fits you. The whole staff is friendly and helpful. I have recommended his company to several of my friends."

- Beni

"Everyone is friendly and very knowledgeable regarding the products they represent. Staff is professional and explains often complex situations so that all parties understand."

- Bill

"Jim and his team clearly explained how Medicare works and our options for supplemental care. With Jim’s help we chose the best plan for our needs and we’ve been exceedingly happy with our care. We’ve referred McGrew and Maher to many of our friends, all have had the same positive experiencing as us."

- Carmen